You must read previous articles and

watch above chart carefully to understand this article completely.

Today’s outlook: -

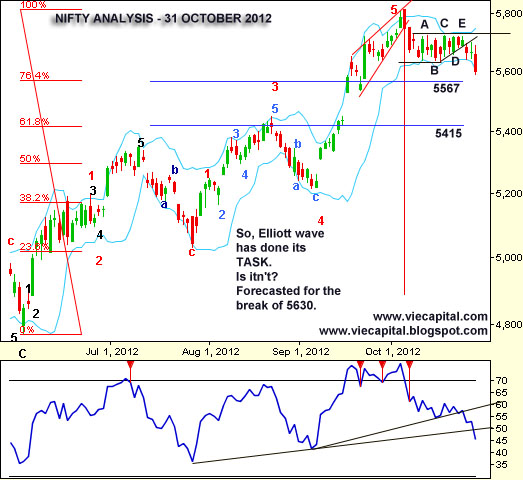

I have already said for the possibility

of recovery yesterday. It was the most expected pullback. It recovered from

5583 and hit a high at 5624 levels which was still below 5630. It was

technically designed pullback. Now, we can conclude that 5630 is missing so fall

will resume. There are chances that we will see the levels of 5567 levels. This

target or support has derived from Fibonacci series. Now suppose if it breaks

5567 then it will surely ready to hit 5500 levels. I strongly believe that

sooner or later Nifty will even break 5500 marks to hit the target of 5450 to

5400 levels. I have already explained those target yesterday based on H&S

pattern.

Have you observed one thing? We have

a consolidation of 5630 to 5730 for 12 trading sessions. I have marks as

consolidating A-B-C-D-E and we got final break of 13th trading

session. It is giving us a hint that upcoming fall cannot be the normal one. Those

who are buying should try being on cautious side. We need to remember that

there where a phase when our market has discounted the fall of European and American

market. Those days have passed and now we will see better correlation.

S&P 500 – I have said that 1475

will remain a yearly top when it was trading above 1460. I mentioned the

importance of 1424 levels. Now S&P is trying to move towards psychological

1400 marks. I must say that 1400 has no technical relevance. We should expect

dip towards 1385 – 1370 levels.

Now, you cannot say that we will not

test 5400 of Nifty if S&P 500 slips by 2-3% more from current levels. So

fall in Indian market is very likely. One can debate over duration of fall or

one can talk about magnitude of recovery coming in between. Yes, it may happen

but fall is expected.

One more thing, you need to watch

out for Reliance today. I am sure you all must be knowing why I am saying this.

Regards,

Praveen Kumar