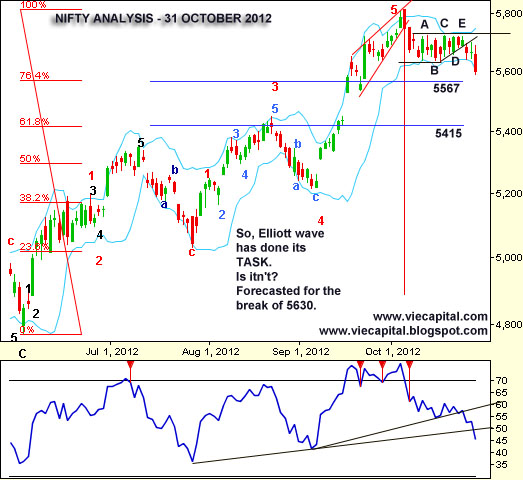

31 October 2012: Nifty Elliott wave analysis: RBI action gave reason for Nifty to break 5630. It has broken and closed lower. Now we can expect more fall. Technical support comes @ 5567.

You must read previous articles and

watch above chart carefully to understand this article completely.

Today’s outlook: -

From past three – four trading

sessions I was discussing about a pattern which was ‘flat top and ascending

lows’. It was a bearish signal and hence we have seen lower break. Yes, we

betted for short trades on many stocks. It was explained based on RSI also

which was giving all sense of weakness. I need to be honest that it was perhaps

most patience testing market for direction. So, finally it seems that we got

the direction.

I have already mentioned that RBI

can have a room to give only 25 basic point CRR cut. Although, I still believe

that CRR cut cannot help anymore. Note that we got 100 basic point of CRR cut

and still repo remains unchanged. It’s really tough to be RBI governor. It is

easy to sit in drawing room and do analysis but it is really very tough to

throw some good plan to handle current situations.

For stock market, Nifty has broken

5630 and Sensex has broken 18500 levels to open newer levels for downside.

It was Elliott wave theory which gave

me the hint of this fall. Now, it will be H&S pattern and Fibonacci series

which can give me probable targets. Fibonacci series is suggesting for

immediate support at 5567 levels, which can be tested by today only. Final support

can emerge as low as 5415 levels only. On other hand H&S pattern is giving

some basic calculation. Length of the head is 5815 – 5630 = 185 points. So the

target should be 5630-185 = 5445. So anyhow we may move towards 5450 at least.

There is another sense for H&S

pattern. Nearly 80% of the time, stocks or indices try to retest N-line for

once. It is suggesting me that Nifty can face resistance at 5630 levels. You can

ask, will it come? Well, I am not very sure but chances are there for a bounce

towards 5630. I am still quoting that it may come but it is not a compulsion to

come. A price break down has already come and it will give its full impact.

Conclusion – we can expect a dip

towards 5567 now and we will have technical resistance at 5630-5650 levels. A

rebound is not a compulsion but it may deserve to come.

Regards,

Praveen Kumar

Join the conversation